Debt Payoff Report

Written by Latisha Grady

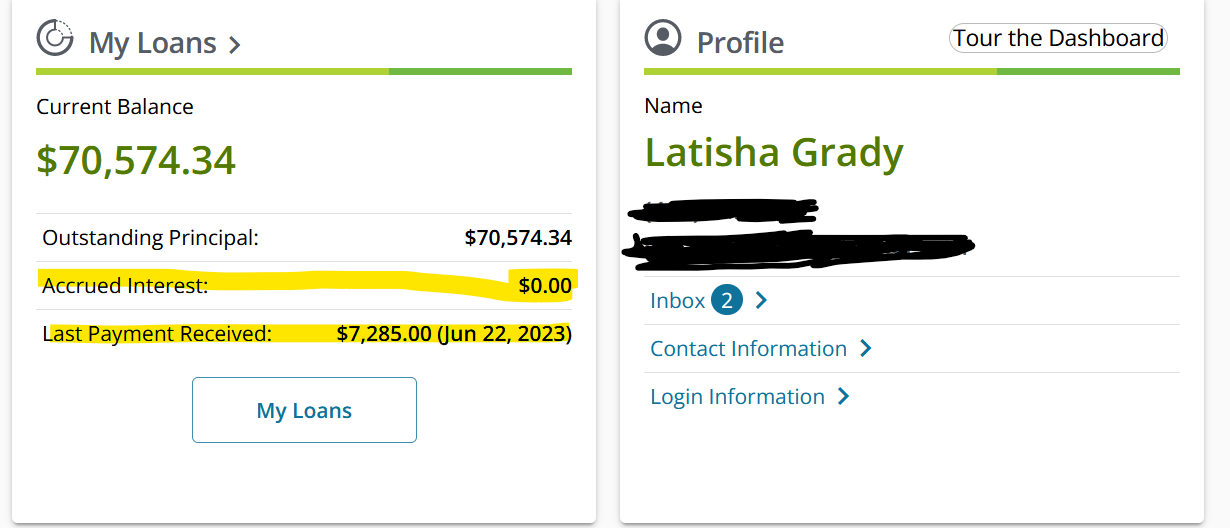

Today, June, 20, 2023, I paid all the accrued interest on my two decade plus old student loans. $7,285.00. To date, I’ve paid a total of $21, 261.46 or 23% of my total debt off.

Student loans made up 85% of my total debt. There are only two loans. One a subsidized loan. The other an unsubsidized loan. These loans were taken out in my late teens and early twenties when I was naive and had no financial literacy to guide me.

How did I get into this mess?

Basically, I over-paid for my education.

Plus, I over-borrowed to cover off-campus living expenses. Similar to buying more house than you need or can afford, I bought more education than I could afford.

Not to mention the elephant in America’s room which is the education I and others have been paying for was, and still is, over-priced.

The consequences of poor financial counsel

Add to that, the poor financial advice Black students, like me, receive from their family, social tribe, and culture.

And even from some Black financial aid advisors.

As a consequence to the unfortunate wealth and knowlege gap (i.e., both personal responsibility and systematic in origin) many Black kids are advised to get through college using loans as if loans are the only option.

For, how many Black students, from poor-to-low to middle income families, have heard the proverbial, “I don’t got no money to send you to school.”

The student loan repayment hamster wheel

The typical cycle of college graduates.

- Keep getting degrees–becoming a career student to take advantage of the in-school deferments

- After maxing out degree programs and deferments option, we begin or resume minimum payments

- Or, we enroll in recurring hardship forbearances or an income-driven repayment plans that minimize or halt payments

- Rinse and repeat steps 2-3

BONUS: We rejoiced when the US Department of Education announced the total halt on all loan repayment and interest accrual due to the 2020 COVID crisis.

I was ashamed of myself

To my shame and chagrin, I could have been paid off these loans.

For I learned from Dave Ramsey your biggest wealth building tool is your income.

I am positive if I tallied up all my paychecks from the first day I started working to date, that I would have earned a million or more dollars as an adult, by now.

How far would I be and how much stress would I have saved myself, if I had been smarter with my money or knew then what I know now.

But again, I console my regret with the proverbial, when you know better you do better.

For I’m now experiencing the adage–it is NOT not how much you make, it’s how much you keep.

For a long time, I lived above my means and didn’t even realize it because the way I was living was very much normal among family, peers, and society in general.

Normal as in robbing Peter to pay Paul. Not budgeting consistently–if at all. Surrendering to the mental blocks that prevented me from sticking to the many debt pay-off plans I made and failed to execute.

The year my financial life improved

This unproductive pattern began to change in 2020 when I was over a year into a steady job and had drastically reduced my living expenses.

Unbeknownst to me at the time, God moving me back home to be caregiver for family members was the best thing that happened to me, financially speaking.

I was finally able to get some clarity and baring. I was no longer under the stress of Atlanta living expenses.

I’ve been taking big bites of my debt and chewing slowly over the past five years vs. eating my debt in small bites.

Like deep sea diving, I go down deep then come up to rest and reset, then go back in and down again.

This huge interest payment represents one of those deep dives. Last deep dive was in 2020-2021 wiping out my medical and old consumer debts.

For 15% of my total debt was medical and small debts. $13,775.48 to be exact.

I’ve been taking this bite-a-huge-chunk payoff approach since 2020 because during this emotionally taxing time in my life, it was the only repayment pace for which I had emotional capacity.

In conclusion

I’m happy to report that I’m moving in the right direction and picking up momentum to eliminate this final debt in the next 18-24 months.

Finishing my business degree in 2022, has opened more doors for my multiple skills to be noticed and earn more.

To that end in January 2023, I finally got what I considered to be a dream job, in my industry of interest, and the role for which my skills and degree prepared me.

I finally have the income and room in my budget to keep to a 36-month pay-off plan.

I’ve been intentional to sacrifice living space and privacy to live below my means so that living expenses remain low. Also, I’ve developed a strong allergy to car notes that keeps my living expenses lower than the average person my age.

Paying off this big chunk of interest at once, tonight, is a huge mental win for me because I see a nice dent in my loan balance. I see a pathway to start attacking the principal now that all of the accrued interest is gone. Until next update.

Update: 2/2/24

I was laid off today. I was a contract-employee hoping to become permanent. But due to the uncertainty around a recent company merger, the inflationary economy, and the budget contraints it created my role was determined non-essential.

So this interrupted my plan to get back on my student loan repayment schedule to kill this debt and rebuild my savings.

I had savings auto-transfers from my account set up to resume on 2/15/24 that I had to cancel when I got the news.

Regardless, I’m confident 2024 is my financial glow up year as 2023 was a stabilizing year. It was the year I doubled down on lowering my expenses–tremendously. To the point, I’m living close to minimalism.

The plan is still the same. Get a long-term full-time role that pays me my worth to resume debt repayment, ERFund, and investing. Once I’ve established a consistent rhythm there, I can begin to reapply energy to my entrepreneurial bucket list to create other consistent income streams.

My previous entrepreneurial experiments was me side-hustling backwards. I was getting ahead of myself. Effectually, I was gambling putting money into my side hustle experiments BEFORE I, significantly, reduced debt. I found that when I reduced debt, I had more disposable income.

Because I didn’t have a solid emergency fund and a clear plan, I was never all in. I was throwing stuff at the wall, entrepreneurially, to see what would stick. In hindsight, I could not be all in because I had no financial safety to help me be fully present in the business and alleviate the anxieties that came with all the financial uncertainties and waiting that come with starting a business. I had to live. I’m not married and had no parental financial support me at those times. I am all I have. While higher than most, my risk tolerance has lowered as I’ve aged.

Today, I have a plan. I still have a few loose ends in my financial portfolio to tie before I feel comfortable pursing a business idea again.

For, I will not pursue a business idea, again, until I have the emotional and financial capacity to be all in.

I’m searching for a role that will pay me above average to collaborate with people who are solving real world problems in an innovative way while sharing my values. A job that I will enjoy showing up for.

So, until my next update telling you that I received the job I prayed for, my student loan repayment journey is paused.

Do you know what you can do when you have no payments? Any thing you want.

-Dave Ramsey